Hawaii's housing affordability crisis persists, posing significant challenges for residents, businesses, and the overall economy. A recent report highlights that housing costs remain exceptionally high, with little relief in sight. According to a recent report published by the Honolulu Star-Advertiser, affordability has further eroded, emphasizing the need for immediate action.

The situation is exacerbated by several compounding factors. Kitv.com's analysis indicates that Hawaii continues to have the highest housing and rental costs in the nation. This, combined with high interest rates and a constrained housing supply, has resulted in fewer single-family home transactions. Furthermore, Civil Beat's report points out that a substantial number of properties are owned by non-residents, contributing to the demand pressure. Notably, permitting delays and infrastructure costs further increase the price of new construction, making it difficult to increase the housing supply at a pace that addresses the affordability crisis.

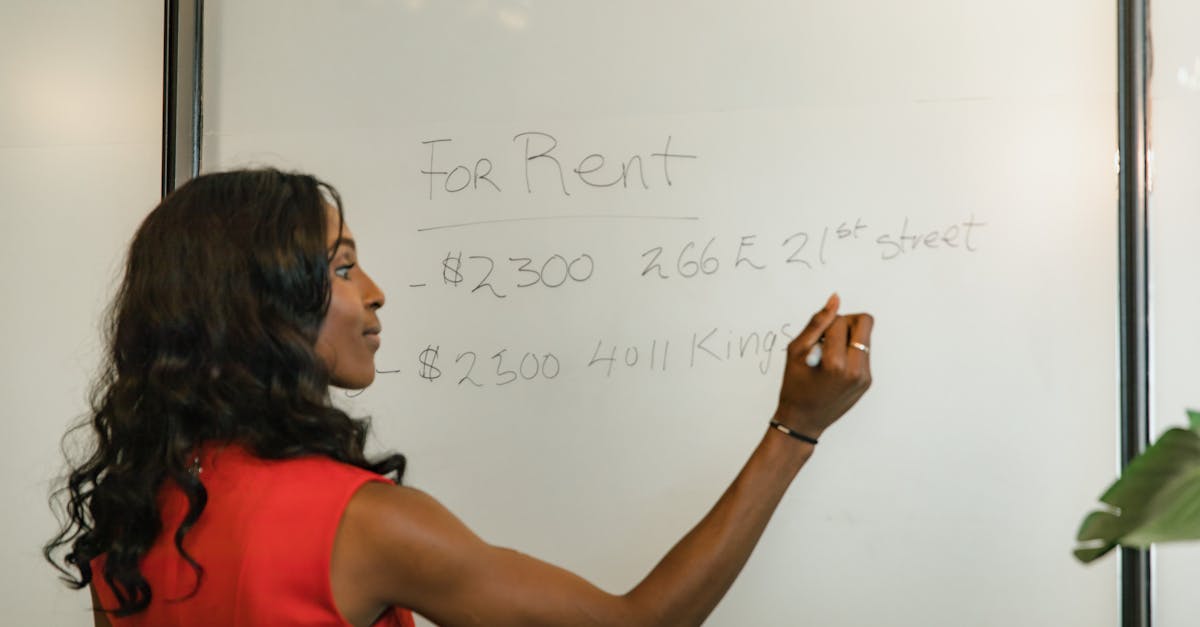

For entrepreneurs and investors, the high cost of housing presents several challenges. It affects the ability to attract and retain a skilled workforce, as employees struggle with high living expenses. This can lead to increased labor costs and reduced competitiveness. Furthermore, the high cost of real estate impacts investment decisions, potentially discouraging new ventures or expansions. The real estate market continues to be affected by market influences, such as interest rates and low supply, making it difficult for many to purchase or rent property.

Policymakers and developers are attempting to address the issue, but progress remains slow. The state is not building enough housing to meaningfully impact affordability, and there are significant issues with permitting delays and other factors that increase the ultimate cost of housing. The article highlights the need for innovative solutions, including policy changes to streamline permitting processes and incentives for developers to build affordable housing units. Addressing these underlying problems could improve the long-term economic outlook for the state.